Promissory Note Template Free

If you are loaning or borrowing money, a Promissory Note outlines the terms of the agreement including payment details, interest if any, late fees, collateral if any, and more. This Note also details what happens if the debt is not paid.

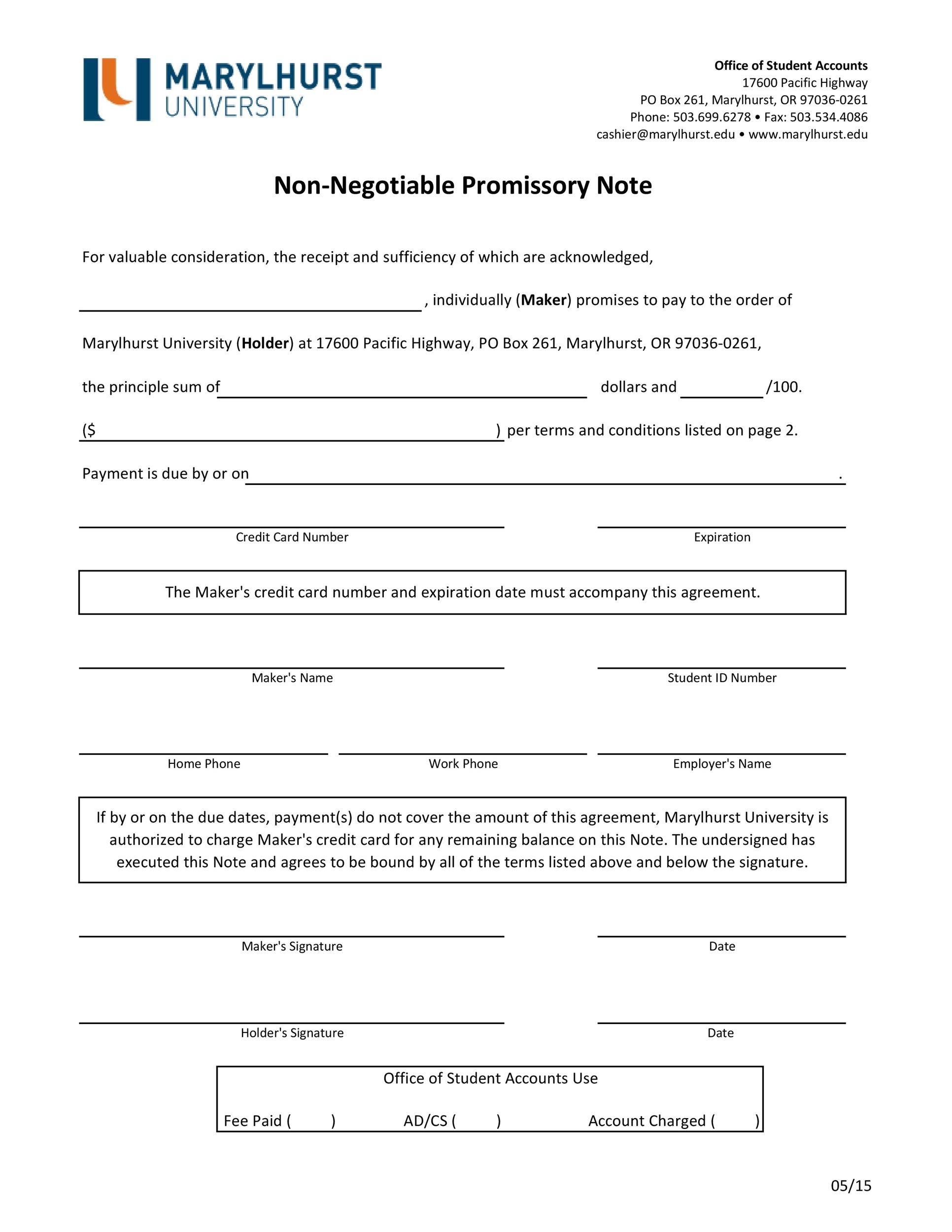

A promissory note form is typically used for personal loans, to loan money, real estate transactions, business loans, and student loans. Step by Step Instructions to Create a Promissory Note Step 1: Create the Terms for the Agreement. A promissory note is a legally binding contract between a lender and a borrower.

- You want to loan money to a friend or family member and want a signed agreement.

- You want to borrow money from a friend or family member and want to show that you plan to repay the debt.

- You are going to loan money and want to charge interest and need an amortization table.

- You are borrowing money and want to put up collateral to secure the loan.

What is in a Promissory Note?

A Promissory Note is simply a loan agreement. It documents the amount loaned and how it will be repaid. It is often a personal loan between friends or family members, but it can be between businesses as well. This type of Note is a bit more formalized than an IOU or handshake agreement, but easier to obtain than a bank loan.

Promissory Notes do not require a lot of information to make. The Rocket Lawyer document builder automatically generates the legal language for you, you simply need to submit a bit of information to customize it.

Information required to make a Promissory Note include:

- Contact information: for the lenders and the one accepting the loan and co-signer if applicable

- Interest rate: if interest will be changed, the interest rate and a higher rate after late payments if applicable

- How payments will be made: installments plus interest, interest-only payments, lump sum or on demand

- Frequency of payments: how many payments will be made, when payments will be made and balloon payment amount if required

- Late fee: will they be charged and if so, when and how much

- Collateral: if collateral will be applied you'll need to write a description of the property

- Loan sale: can the lender sell the loan?

In most cases, a handwritten Promissory Note signed by both parties will stand up in court. However, using our form is simple and it can incorporate interest and build an amortization table. Plus, our document builder incorporates legal language into the document automatically.

What is fair interest rate to charge a friend or family member?

Some people are uncomfortable charging their friends or family members interest for loans, but you may consider at least charging a bit since that money will not be able to work for you in other ways until it is paid back. You can charge whatever interest rate you want, but in general, most choose to charge a bit less than what a bank might charge for a personal loan. Many choose to charge between five and ten percent interest. Many states have usury laws that limit how much you can charge for interest. Even if it is a personal, private loan it is prudent to stay under the usury limit in case you end up in court for nonpayment in the future.

Should I ask for collateral to secure a personal loan?

Collateral can sometimes help motivate the person you loan money to, to pay you back. Other times, they may think they don't have to pay you back since you can take their collateral. Before accepting collateral in the terms of the loan, you'll want to evaluate the value of the collateral and maybe even make arrangements to take possession of the collateral until the loan is paid in full. Common items used for collateral include real estate, cars, boats and recreational vehicles.

Most financial advisors would say no. However, each situation is unique. You can never actually know for sure if someone will pay you back. They may lose their job, become ill, or simply choose not to pay you back. Many family disputes have arisen and friendships dissolved over money issues. A few recommendations include to never loan money you cannot afford to lose, to loan money already accepting you may never be paid back, and if you choose to lend money—get it in writing (always, even if it is your own mother).

Promissory Note Template Free Car

How to collect a debt: What to do if they don't pay back the Promissory Note?

Installment Promissory Note Template Free

It happens. Sometimes you are not paid back according to the agreed upon terms. Relationships are often strained when a friend or family member doesn't pay back their loan. Some choose to write off the debt to avoid confrontation, but if the loan is large, you may really need the money back. Here are a few things you can do to attempt to receive payment, listed from the least intrusive to expressing your legal rights.

- Talk to them. Maybe their life has become stressful and they are not handling their finances well or they simply forgot. They may be embarrassed and have avoided talking to you about their debt. If you open the lines of communication, you may be able to make a repayment arrangement.

- Send them a copy of the loan agreement. Sometimes the person who owes you money may have forgotten the details of your arrangement. Send them a copy that shows their signature. Sometimes them seeing that you have legal options you could pursue may entice them to make payments.

- Send a certified letter. If you are not sure what to include in the letter, you can use our Demand for Money Owed template to make the letter.

- Document everything. Put together a folder that includes a copy of the original agreement, notes about phone or in-person conversations, copies of the letters sent, and the dates of all correspondence. This information will be useful should you end up in court.

- Consider a Debt Settlement Agreement. To recoup your losses, you may consider a Debt Settlement Agreement.

- Hire a lawyer. If your letters have not persuaded them to make payments you may need to take it to the next level. You may need to contact a local lawyer to send a letter. If you have a Rocket Lawyer Premium Plan, you can utilize discounted lawyer services to have the letter drafted. If you are a business, you can hire a debt collection agency to help you collect the debt.

- Go to court. If your letters and demands have failed, you may have to go court to collect the debt. If the debt is small, small claims court may be sufficient. Whether it's a small or large debt you'll want to follow the advice of your lawyer to increase your chances of collecting the debt owed to you.